The French armies were so confident of victory that they were only given maps of Germany.

By the end of May, 1871, much of Paris was consumed in flames, put to the torch by many of the same people who were singing patriotic songs just 10 months earlier. The River Seine literally ran red with the blood of tens of thousands of Parisians, shot by French soldiers who were taking no prisoners. The French government did nothing to stop this orgy of killing, while the French press compared anyone who resisted to "wild animals" and "appalling monsters."

How could this drastic change have happened in less than a year?

This is part three of a four part series. You can find Part 1 and Part 2 at the links.

First as Tragedy, Second as Farce

| "The object of our greatest concern was to repel the forces of anarchy and to prevent there being a shameful revolt in Paris." - Jules Favre, on the eve of war with Prussia |  |

Between 1789 and 1851 France had seen four successful and bloody revolutions, two successful and bloody military coups, and at least seven unsuccessful and bloody revolts. Political stability was not a value shared by many in France. During that same time the only war France had lost occurred when all of Europe fought against it (and sometimes not even then).

With that in mind it seemed logical for France's military to be structured to defeat domestic threats, rather than foreign ones. However, it left the French military horribly unprepared for the rising German Empire.

One defeat followed another. Eventually the Army of the Rhine was surrounded at Metz on September 3. Emperor Louie Napoleon's 104,000-man Army of Châlons was quickly surrounded and defeated at Sedan on September 2. The Emperor himself was now a prisoner of war.

There were no other armies left in France except for isolated garrisons. In just 6 weeks the bulk of France's military might was either hopelessly surrounded or already in Prussian prisons.

But the war wasn't over. Not even close.

Back in Paris the public was still unaware of how badly the war was going. The reason was simply because the French government was scared of its citizens.

So the public was unprepared when the double-dose of bad news from Sedan and Metz reached Paris on September 4. Well, not all of the public was unprepared. The Jacobins, Blanquists, and Republicans were prepared to act.

"In the presence of our disasters and in the face of the misfortunes of the country the people of Paris had invaded this place to proclaim the Republic and the downfall of the Empire."

- Ernest Granger, a Blanquist, speaking from the Presidential Chair after the crowd had stormed the Hotel de Ville

It was the first and only bloodless revolution in French history. The public stormed the government buildings as they were in session, while the army and National Guard refused to fire on them. (This had been done so many times that there was even traditions for how to properly conduct a revolution.) France's Third Republic had been born.

Meet the New Boss...

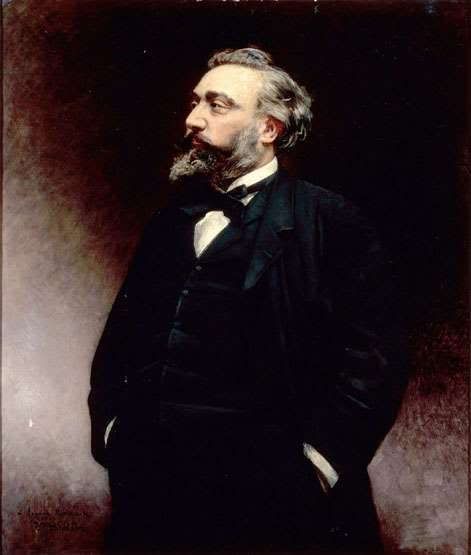

Most of the deputies of the Government of National Defense, as it was called, were deputies under the old regime. Names like Jules Favre and Adolphe Thiers (who was a monarchist) continued to populate the new government. It was only a minority of Blanquists, Jacobins, and socialists who realized that the revolution had been undermined, again. There were only three notable exceptions:

| Henri Rochefort was a journalist and republican. Although he was already an elected member of the Chamber of Deputies, he was in prison and condemned to die at the time of the September Revolution. He freed from prison by the mob and became one of the Ministers of the new government. |

| Leon Gambetta was a lawyer and made famous for opposing the Emperor. He was elected to the Assembly in 1869 and became a political opponent of Thiers. He was a patriot and republican to the end. He became Minister of the Interior and Minister of War. |  |

| Louis Jules Trochu was a general, not a politician, when the war began. He had long ago cemented his reputation as a competent general, but had fallen out of favor with the Emperor for his vocal criticism of the organization of the military (criticisms which were very prescient). Trochu was governor of Paris and commander-in-chief of all the forces destined for the defense of the capital at the time of the September Revolution. On September 4 he became the President of the new government. |

Heroic Folly

The government had gone from a monarchy to a republic, but the most important development was its consistency on a single issue: the war.

"France will not yield to Germany an inch of territory nor a single stone of the fortresses."

- September 6 declaration

This attitude conflicted with Prussia's territorial ambitions, which desired the Alsace-Lorraine region, as well as a lion's share of France's gold. Otto Bismark cautioned against this demand because he believed it would inevitably lead to another war, but was overruled by Germany's politicians.

In reality the new government was eager to negotiate an end to the war, and the declaration was for internal consumption only. This conflict between official bombastic rhetoric and diplomatic efforts to appease Prussia, which also meant a passive military response, naturally led to suspicions of treachery.

Germany's immediate concern was that it had no opposing army anywhere near its current forces. Except for the army trapped at Metz, the closest garrison of any size was at Paris, several weeks march away.

Trochu had no illusions about France's chances. With no trained army Trochu had nothing to build with. "We will defend ourselves, but it is heroic folly." As Trochu put it, they were there "simply to accept defeat on the field of battle."

Perhaps even more importantly was the the absolute disdain the generals held for the republicans in the new government, and for a republican government itself. They were Bonapartists to a man. It was this attitude that led to comparisons to 1792-93, when the monarchists generals showed no real effort to defend the new republic against the invading Prussian armies.

The public called for another levee en masse, just like 1793, in order to save the fledgling republic from its untrustworthy generals. Trochu refused. However, a compromise was created in which 134 new National Guard battalions were formed in Paris, 300,000 men in arms total.

Since the June Days Revolt of 1848, only the bourgeoisie had been allowed into the National Guard. Thus the working poor, the ones more likely to revolt against the government, were kept unarmed. This now changed, as almost all of the new battalions were workers. This was to be the most critical development in the formation of the Paris Commune.

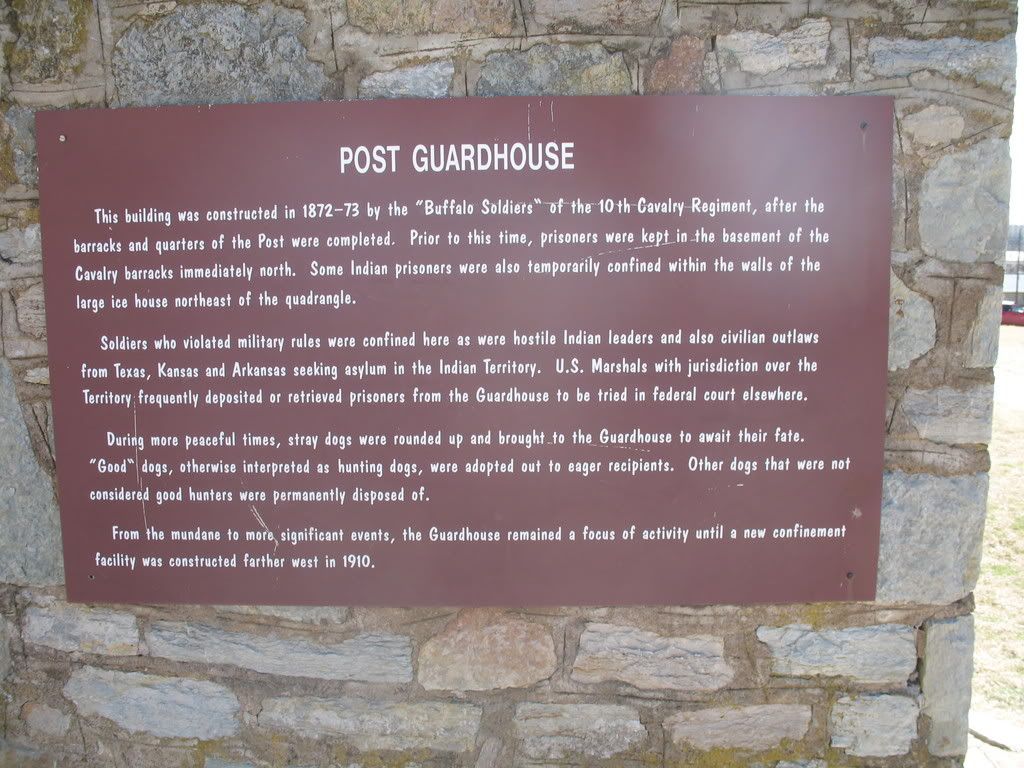

The Siege

The Prussian army arrived at the suburbs of Paris on September 15, and finished surrounding Paris by September 19. Paris was cut off from the rest of France for the duration of the war.

On October 3, Gustave Flourens, a commander in the National Guard, led five battalions to the Hotel de Ville to protest the near complete lack of military response to the Prussian advance. The government response was to ban all demonstrations for the duration of the war, and to postpone the municipal elections (Paris didn't have a municipal government since 1848). Both of these actions caused a split between the moderate republicans and the revolutionary/socialist wing.

Shortly afterward Léon Gambetta left Paris by balloon on October 7 in order to organize resistance in the provinces. The balloon of the time was a one-way trip, of which there was 66 of them. None of them were ever shot down.

On October 29 General Carey de Bellemare, one of the army commanders, chafing at the inaction of the government, took it upon himself to seize a nearby suburb of Paris. It was not a strategic area and Trochu not only didn't follow up on the advance, but actually berated the general. The following day the Prussians recaptured the town and took 1,200 prisoners in the process. The public was outraged by this passive response from the government.

On October 31 the government admitted to the surrender of the army at Metz. This news was officially denied on the 27th when it was reported by the socialist press. On top of this disastrous news, it was also revealed that Thiers was negotiating an armistice with Prussia, revealing the government to be liars again. This was the final straw for many.

Thousands of National Guard from the working class districts began assembling in the square in front of the Hotel de Ville carrying signs of "Viva la Commune" and "Le levee en masse". The government sounded the rappel in the "good" bourgeoisie districts for protection, but they failed to turn out.

It was during this time that about 400 Blanquists showed up and led the crowd into the building. They broke open the doors to find the government in session. Around this time Flourens showed up brandishing his sword, leading his battalion of National Guard, their weapons loaded.

The demand was for elections of the Paris Commune. Lists were drawn up and tossed to the crowd through open windows in order to poll the responses. Blanqui, hearing that his name was on a popular list, now showed up.

By all appearances, a new revolution had taken place. Unlike the September Revolution, this one had a distinct socialist flavor. Blanqui and other delegates retired to a separate room to begin issuing proclamations (like closing the gates of Paris). However, all was not as it appeared.

Trochu and many other government officials had escaped by a secret exit from the building. They gathered together several of the "good" battalions of National Guard, and a whole infantry division, and marched on the Hotel de Ville. A standoff occurred until the leaders agreed that the government would hold elections for the Commune with universal suffrage and that there would be no reprisals. The building was evacuated and all appeared well again.

The very next day the government went back on its word. Six of the more prominent leaders (who were supposed to be in the new government) were arrested in the next few days. Arrest warrants for Flourens and Blanqui were also issued, but not enforced because they resided in the Belleville district, where even the army feared to tread.

The Grand Sortie

While Paris was under siege, Gambetta was stirring up the provinces. Withing a few weeks there were five new armies, with 500,000 men under arms. Prussia had neither the men nor means for an occupation of the whole of France.

On November 9 the new French armies defeated the Germans at Orleans, thus cutting a wedge into the Paris encirclement. Trochu had already been planning an attempted breakout, but it was in the opposite direction of Orleans. The new developments convinced Trochu to change the direction of the attack, which forced 1) a delay in the attempt, 2) eliminated the element of surprise, and 3) caused the attack to run into the teeth of the Prussian defenses. Thus the french efforts at the Battle of Villiers were doomed before they began. Both the Paris attack and the Orleans attack had been delayed by Thiers so as not to interfere with the armistice talks.

"We have had the misfortune to see our cleverly conceived plan of offensive endangered by the intervention of M. Thiers."

- letter from Gambetta to his deputy

By December 4 the French forces were driven back into Paris. On the very same day the Germans reconquered Orleans. Parisian hopes of victory had been dashed. Another attempt at breaking the siege was made on January 19, but it was even more poorly executed than the first.

Winter set in. Food and fuel began to run out in Paris.

Here's a translation of a typical Paris menu from the times.

Even worse was the system of food distribution called "rationing by dearness". In other words they trusted Adam Smith's 'invisible hand'. This meant a system where the rich ate plenty while the poor starved.

"One must truly render justice to the Paris population and admire it. It is astonishing that this population, confronted by the insolent display in the food shops, heedlessly reminding a population dying of hunger that the rich with their money could always, yes always, obtain for themselves poultry, game, and other delicacies of the table, did not break the shopwindows nor attack the shopkeepers and their goods."On January 22 a few National Guard battalions from the working class sector staged a small demonstration in front of the Hotel de Ville to protest the incompetent way the war was being handled. Suddenly the guns of the mobiles inside the building opened up and bullets poured down upon the crowd. About 30 National Guards and civilians were killed.

- Edmond de Goncourt

The government responded to the massacre with more repression. Some eighty arrests were made and leftist newspapers were banned.

Just three days later the guns of the Prussians opened up on Paris. The bombardment had begun. Three days after that the French government surrendered, caving in to all of Germany's demands. The war was over.

Gambetta refused to accept the surrender. He resigned instead, as did the representatives from the Alsace region.

Another problem of the armistice was Germany's insistence on disarming the National Guard and reducing it to just 10 battalions. The French government admitted that they could not do this, as doing this would cause its overthrow. Bismark coldly suggested that if that was indeed so he should "provoke an uprising, while you still have an army to suppress it with." Favre threatened to hand over the task to the German army. Bismark balked at this and agreed that the National Guard didn't have to be disarmed.

The upper classes greeted news of the armistice with joy. With the end of the siege, those who could afford it began leaving Paris.

The working class, on the other hand, felt betrayed. It was the rich who started this war, but it was the poor who had suffered. It was the rich who betrayed the revolution after the poor had made it happen. It was the rich who didn't care about winning the war after the poor fought and died for it.

The working class was stunned, but they wouldn't stay that way for long.

This is the end of part three.

Labels: La Commune, midtowng