All the great progressives in history rolled over in their graves the day this worthless legislation was proposed. You would never know that the progressive left was founded on Big Economic Ideas after reading this bill.

With this complete lack of direction from the political leadership as an example, I have to wonder if the average progressive is similarly ignorant of all the great ideas that have come before them. So I decided to present just a few Big Ideas from a proud history. None of these ideas are strictly socialist, but all of them have been tried before and worked.

This is nowhere near a full compilation of ideas. It's merely an attempt to get people to think outside the box.

The Single Tax on Land

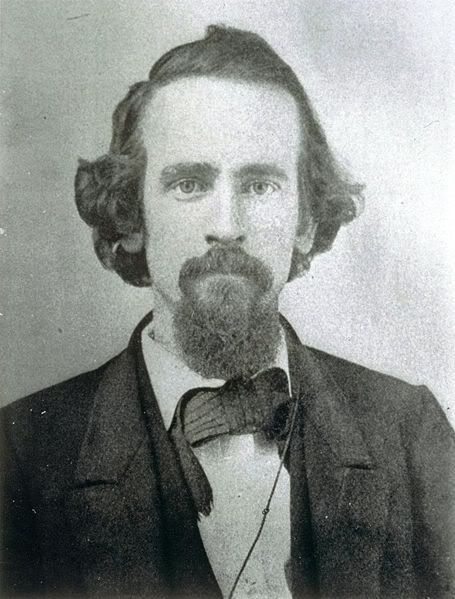

Let me introduce you to a 19th Century American economist that has been mostly forgotten - Henry George.

One day, while inquiring about the price of land in an area, it suddenly occurred to George that there was a connection between advancing poverty and advancing wealth. The philosophy of Georgism is simple:

everyone owns what they create, but that everything found in nature, most importantly land, belongs equally to all humanity.

While Georgists are largly right-wingers, the idea has found sympathizers in the environmentalist movement

There is a delusion resulting from the tendency to confound the accidental with the essential—a delusion which the law writers have done their best to extend, and political economists generally have acquiesced in, rather than endeavored to expose—that private property in land is necessary to the proper use of land, and that to make land common property would be to destroy civilization and revert to barbarism.This may sound radical and unworkable in today's world, but you would be wrong.

This delusion may be likened to the idea which, according to Charles Lamb, so long prevailed among the Chinese after the savor of roast pork had been accidentally discovered by the burning down of Ho-ti’s hut—that to cook a pig it was necessary to set fire to a house.

In Hong Kong, the most capitalist society in the world, all land is owned by the government, which gets 35% of its tax revenue from all rents. It is thus able to keep all other taxes low.

Henry George was a strong union supporter. He died in 1897 after running for mayor of New York on the United Labor Party ticket.

Corporations are NOT people

Monster corporations that seem to control all the levels of government and law, is a beast that didn't exist before the Industrial Revolution. At one time corporations had to get a charter to exist, and those charters generally expired after a period of time. These temporary creations were treated much different than today.

Corporate law at the time was focused on protection of the public interest, and not on the interests of corporate shareholders. Corporate charters were closely regulated by the states. Forming a corporation usually required an act of legislature. Investors generally had to be given an equal say in corporate governance, and corporations were required to comply with the purposes expressed in their charters.What happened? The Supreme Court decided to give corporations the rights of an "artificial person".

Imagine a political system that wasn't owned by corporate lobbyists. Imagine corporations that had to answer to the community. That's the kind of world we can have again if corporations had to exist by charters that served the common good and then expired.

So why did this system end? Short-term thinking.

Eventually, state governments began to realize the greater corporate registration revenues available by providing more permissive corporate laws.Think Different Banking

Bank runs, the boogyman of generations, don't have to happen. Nor does the enormous amounts of debt that permeate every sector of society. Both of these things are allowed to happen by our corrupt political leaders.

#1) In 1609 the Bank of Amsterdam (Amsterdamsche Wisselbank) opened. The Bank of Amsterdam was one of the largest and most successful international banks in the world for 150 years. It did most of the things that you would think of a normal bank doing today, with one large exception - the Bank of Amsterdam had 100% deposit reserves. There was no bank runs on the Bank of Amsterdam because there was never any danger of your money not being there.

However, that wasn't the reason why the Bank of Amsterdam kept 100% reserves.

The principal purpose of the Bank of Amsterdam, however, was not toA debased currency is a related problem and totally applicable to our experience today. The fractional reserve banking system is a huge monetary inflation issue. Thus fractional reserve banking causes two systemic problems with our fragile financial system.

protect against the failure of private banks, but, instead, to discourage the

circulation of debased coins.

So if banks can still function and prosper without a fractional reserve system, why do we allow it? Hint: it has to do with the bankers making ungodly amounts of money.

#2) Albert Einstein is reported to have said, “The most powerful force in the universe is compound interest.”

Americans have accepted the idea that loans always come at interest. It's normal and natural, especially to banking. We never even question the usury interest rates we are being charged. In fact, I would be surprised if most people even understood how compound interest works.

One thing is for certain, the people who wrote the bible understood it.

"If you lend money to any of My people who are poor among you, you shall not be like a moneylender to him; you shall not charge him interest."

- Exodus 22:25

That is merely one of dozens of quotes against charging interest on loans. You might remember from your bible studies that the only time that Jesus ever got violent was against the moneychangers who were charging interest in the Temple. Jesus didn't live long after that, and the Christian religion didn't seem to take Jesus' example to heart.

But the Islamic religion did.

You might already be aware that according to sharia law, banks can't charge interest on loans. While no islamic bank is huge, they are all more stable than the current western banking system and the system has existed for over 1,300 years.

But instead of dwelling on Islamic banking, I would like to point you towards Sweden. Specifically, the Swedish JAK Medlemsbank (Members' Bank), which was founded during the depths of the Great Depression. It also doesn't charge interest on loans, and it is considered "the safest bank in Sweden."

So if banks can function without charging usury, and the bible repeatedly says it is wrong, why do we allow it? Hint: it has to do with the bankers making ungodly amounts of money.

#3) The U.S. Constitution says that Congress has the power to coin money (i.e. create money). It also says that no state can "coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts."

So why do we borrow paper money, at interest, from the Federal Reserve - a private cartel of banks? Why do we pay interest to create money that the American taxpayer is responsible for? Hint: it has to do with the bankers making ungodly amounts of money.

But before we go down the road of why have a central bank at all, let's look at a more modest alternative: why have a central bank that is controlled by private bankers?

The People's Bank of China is controlled by state-run banks. Thus if any money is paid to the central bank of China, at interest, it goes to the federal government's budget rather than to the pockets of greedy, private bankers.

The solutions to our current, chronic, economic problems are out there. What is keeping us from applying the cures is a lack of imagination, a stagnated political system dedicated to maintaining the economic status quo, a lack of leadership and courage at the top, and an economically ignorant populace.

These ideas I list here are just a tiny percentage of what is available and successfully tried. The question is how many more generations must we endure this corrupt and dysfunctional economic system before we try something more stable and fair?

Labels: midtowng

Ahistoricality on 10/10/2008 11:21 PM:

Hahnel and Albert's "participatory economics" seemed absurd when they unveiled it ten years ago or so, but Mark's right: the web and computing technology available today makes it considerably more viable over much larger scales than previous collective systems. (Unfortunately, Mark, "when markets are free in the technical sense used by economists" happens when pigs fly: the theoretical defense of capitalism is pretty thin gruel at this point.)

The larger point, though, is very interesting: our current economic system rests on a number of premises, each or all of which should be questioned.

Unknown on 10/10/2008 11:23 PM:

Unless I am mistaken, you are talking about a commune.

My most recent historical obsession is the Paris Commune of 1871. Obviously it was crushed (in a bloody massacre of tens of thousands) before there was an opportunity to see if it could work in the long-run, but it appeared to be working in the short-run.

I've been wanting to do a diary about the Paris Commune, but there is so much material that I don't know how I would condense it into a single diary.

Unknown on 10/10/2008 11:51 PM:

Midtowng, I'd love to see that diary, even if it has to become a series.

On another note, what makes you say that Georgists are predominantly rightists? My understanding was that George was considered to be a socialist in his own time.

Incidentally, George is also one of only three men who could say they beat Theodore Roosevelt in an election. The others were Abram S. Hewitt (the eventual winner of their three-way mayoral race) and Woodrow Wilson.

Ahistoricality on 10/11/2008 12:33 AM:

Unless I am mistaken, you are talking about a commune.

Actually, Parecon, as Albert calls it, is a fully scaleable system intended, ultimately, to be all encompassing.

It is communalistic, yes.

I know a bit about the Paris commune, but I'm more interested in the utopian socialist communities like New Harmony and Amana, which survived for years.

I had a passing thought a couple days ago it just maybe my prejudices of the Bush administration.

Could the world markets be paying the Bush administration back for his 8 year rein of global finical terror, military terror, and oil manipulation? It was just a passing thought.

The oil companies were sitting in a good position with large cash reserves. Yet they have lost a 1/3 of the value in a few months a smart investor could come in and rip off all the cash with the stock prices down. As the markets tumble and a few billionaires lose their ass just maybe somebody will throw the Bush administration under the bus for good.

http://www.bloomberg.com/apps/news?pid=20601039&sid=akIQ2arQB4Qs&refer=columnist_pauly

Time out; why do we have to buy the bad investments?

Let’s buy Exxon then double our investment and then fix the crisis with the profits. The oil companies were sitting in a good position with large cash reserves. Yet they have lost a 1/3 of the value in a few months a smart investor could come in and rip off all the cash with the stock prices down.

Gold Standard, R.I.P., _please__!!!

please see also:

http://en.wikipedia.org/wiki/Great_Depression_in_the_Netherlands

"The Stock Market Crash of 1929 initially didn’t have very large effects on the Dutch economy. Dutch Stock Market prices decreased somewhat, but not strongly enough to cause a real depression. Stock market prices had not been very high to start with, and large scale speculation as in the United States (partly on borrowed credit) had not taken place in the Netherlands. Instead of a sudden crash a process of gradual decline set in. As exports declined further and Germany’s temporary economic upturn evaporated because of a drain of foreign capital, prices and profits fell in the Netherlands and gradually started a real economic depression around at the end of 1930. The Great Depression in the Netherlands started in earnest in 1931, when Great Britain (an important trading partner of the Netherlands) and the Scandinavian countries dropped the Gold Standard. Within a few years most industrialised countries of the world had dropped the Gold Standard as well, among them the United States in 1933. At the same time trade restrictions were significantly increased further in many of the Netherlands’ main trading partners. The Dutch government did not retaliate with trade restrictions of its own on a comparable scale and trusted on international cooperation to solve its problems. The result of this was that the Dutch guilder strongly rose in value relative to the currencies of its trading partners, making Dutch products relatively expensive and foreign goods relatively cheap for Dutch consumers. Dutch export sectors quickly lost much of their market shares abroad, while in the domestic market Dutch producers faced heavy competition from cheap foreign imports. The result was overproduction, a drop in prices and firm profits, and finally unemployment and wage cuts. The Netherlands was now in a deep economic depression."

John Maynard Keynes,(June 5, 1883 – April 21, 1946)

interesting fellow, with interesting things to say about employment, money, interest, etc.

I recommend his writings for those here who are enamoured of the "stability" of metal-based currencies.

proximity1

"The question is how many more generations must we endure this corrupt and dysfunctional economic system before we try something more stable and fair?"

Things can be more stable than a capitalist market- slave labor economies were exceptionally stable - but I'm dubious that they can be more fair systemically in terms of operation, if left "ungamed" by vested interests.

(Distribution of the accumulated surplus is a different matter. I'm talking about the neutrality of the price mechanism when markets are free in the technical sense used by economists. Unfortunately, as you move toward oligopolistic markets or state sanctioned private cartels, the price system loses it's utility as an efficient and accurate marker of aggegate behavior. When prices are fixed by private monopolies or the state, they effectively lose all rational value)

One alternative I'm surprised that you did not mention was voluntary cooperative production within a larger market. Either the historical example of agrarian coop organizations sponsored by the Farmer's Alliance and Agricultural Wheel in the 19th century that pooled buying and marketing power or today's "Wikinomic" structures made possible by Web 2.0 tech and open-source platforms. Linux being the archetype of open-source competing robustly with corporate closed-source platforms.